The Richest Man in Babylon by George S. Clason

The Richest Man in Babylon by George S. Clason uses a collection of parables to give financial advice. The parables are revolved around a character named Arkad, a poor scribe who became the richest man in Babylon. Even though the book was written nearly a century ago, the principles still hold true today.

A part of all you earn is yours to keep

Some of us are fortunate to be in situations where we can keep a significant portion of what we earn. However, with rent, tuition, family obligations, and leisure, a majority of us might find ourselves in situations where our years of hard work do not result in much savings.

George advocates that everyone should put away at least one-tenth of their earnings to create an estate for their future. Rather than save your remaining earnings after you’ve paid out your expenses, first put away at least one-tenth of your earnings then plan out your expenses. Odds are you will be able to identify and cut down unnecessary spendings.

Even though saving for you and your family’s future is important, George also stresses the importance of enjoying your life in the present. Do not try to save more than what you can comfortably keep. Life is short and full of things to enjoy. Save at least one-tenth of your earnings and save more if you and your family can still live comfortably.

Learn to make your earnings work for you

If what you save can earn for you, then its children can also earn for you, which will enable you to multiply your wealth in the long run. Seek advice from those wise in managing money and handle your wealth accordingly.

For all the financial advices given, this is probably the hardest to accomplish. Finding a safe and profitable way to invest your money is easier said than done. You can place your earnings in your savings account which with inflation doesn’t increase your wealth by much. You can invest in stocks. However, different investment analysts recommend different stocks. You can place your earnings in index funds which can be a good option but it doesn’t yield high returns.

Learning to make your earnings work for you is important. However, I’ll say it’s more valuable to listen to what George advices not to do. Do not invest based on the advice of people who are not experts in the field they sell. Do not trust your own inexperience or desires in investment if it’s not based on sound reasoning and analysis. Do not chase after impossible earnings.

Don’t feel obliged to lend your money to any person

When you become wealthy, naturally a lot of your friends or relatives will seek your help financially. It’s human nature to feel a sense of obligation to help those who are close to you.

Even if you are in a position to lend your money, always take a step back and evaluate. Does the person who you are trusting your money with have a track record of handling money successfully? Are there valid reasons for you to be confident in the person’s ability to pay you back? And is lending your money the best way you can help this person? If the answer to any of the questions is no, find other ways to help. When a relationship involves a large sum of money, it can destroy relationships including with friends and family. Think carefully before you trust someone with your money.

Summary

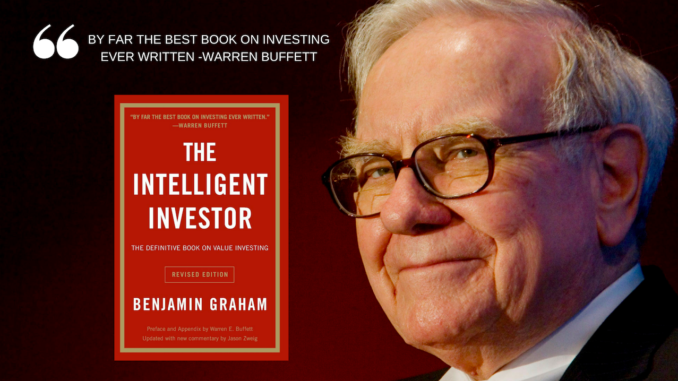

The Richest Man in Babylon contains many valuable financial advices. Despite being a quick read with only 100+ pages, it can feel dragged out with many parables emphasizing the same set of financial principles. It’s a book I would recommend since it can have a positive impact on how you handle your wealth. If you are into the investment side of things and enjoy a deep dive on it, I would recommend The Intelligent Investor by Benjamin Graham.